Press Release

|August 05,2024PropNex Survey Found That Over Four In 10 Of The Respondents Said EC Still Relevant In Meeting Private Housing Aspirations; But Rising New EC Prices A Concern

Share this article:

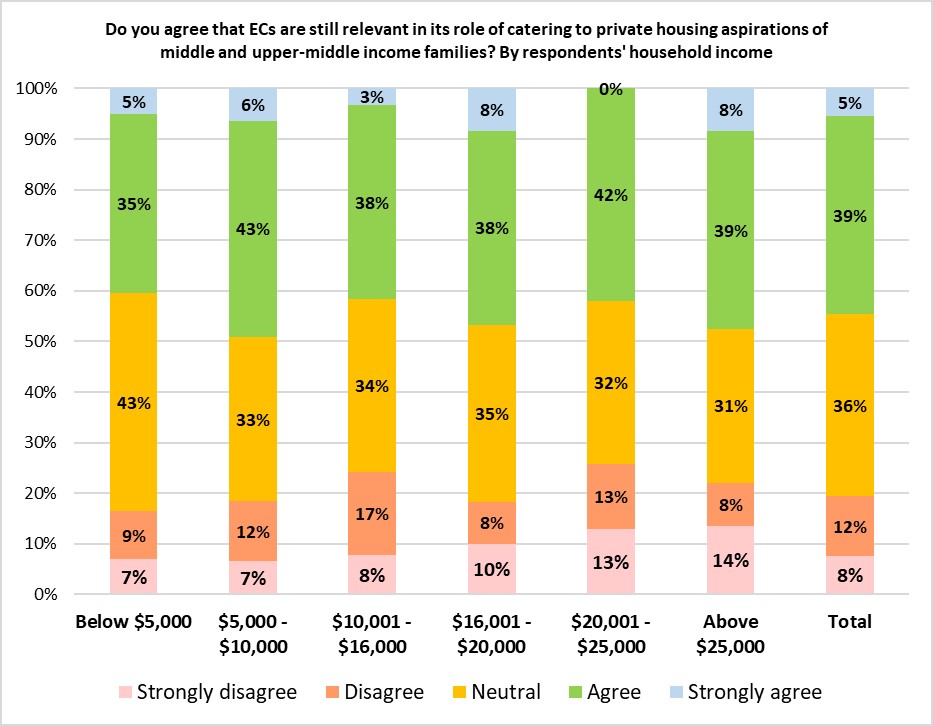

5 August 2024, Singapore - A survey of nearly 1,250 HDB flat owners by PropNex found that more than four in 10 of the respondents polled either agree or strongly agree that executive condominiums (EC) are still relevant in meeting the housing aspirations of middle- and upper-middle income families in owning a private home. The EC housing type was introduced in the 1990s, as an intermediate housing category to bridge the gap between public housing flats and private residential properties - helping Singapore households attain their aspirations of owning and living in a private home.

Many of these households belong to the "sandwiched class", who are unable to apply for a build-to-order (BTO) flat from the HDB as they have exceeded the monthly household income ceiling, but yet find private condos out of reach due to the higher prices. At the time of writing, the monthly household income ceiling for BTO flats for couples/families is $14,000, while the monthly household income ceiling for buying new ECs from developers is $16,000.

Chart 1: Are ECs still relevant in catering to the private housing aspirations of middle and upper-middle income families; by respondents' household income

Ismail Gafoor, CEO of PropNex, said, "ECs continue to be popular with homebuyers in Singapore, and new EC projects generally tend to see stronger sales at launch compared with other private condo launches owing to their more affordable pricing. Hence, it is no surprise that a good portion of respondents (44%) either agree or strongly agree that ECs are still relevant in catering to the private housing aspirations of households (see Chart 1, Total column). However, we note that the rising prices of new ECs may be a concern among many respondents."

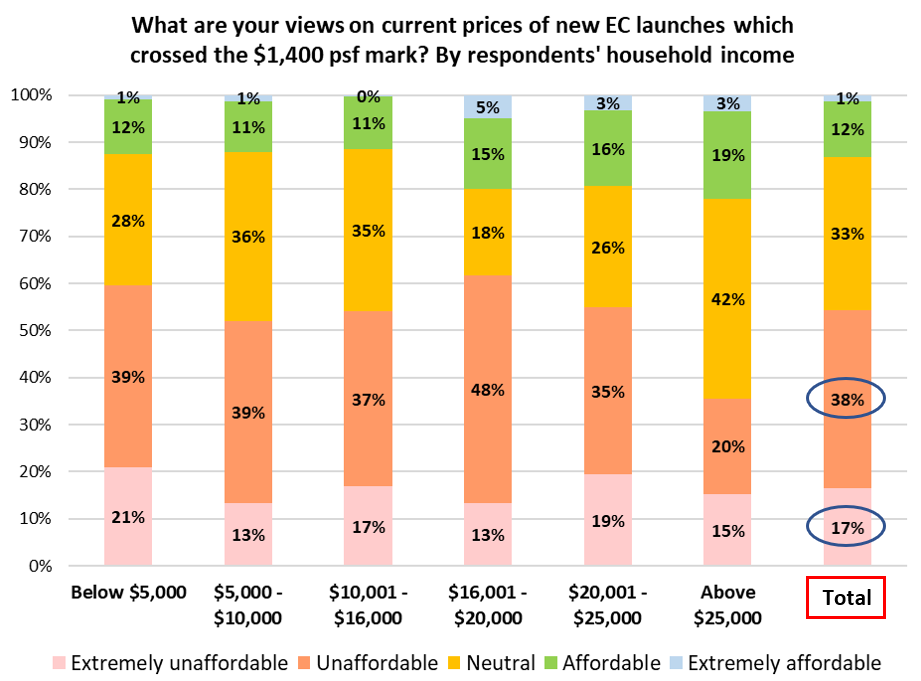

PropNex's survey findings showed that 38% of the respondents felt that prices of new ECs are unaffordable, while 17% of them said that they are extremely unaffordable (see Chart 2, Total column). According to URA Realis caveat data, the median transacted unit price of new EC units has risen substantially in the last few years from $798 psf in 2017 to $1,417 psf in 2023. In the first half of 2024, the median unit price of new ECs has tipped over the $1,500-psf mark.

Chart 2: What are your views on current prices of new EC launches which crossed the $1,400 psf mark? By respondents' household income

Mr Gafoor added, "To this end, perhaps the government can consider tweaking some policies that could help to improve the affordability of new ECs. They could include raising the monthly household income ceiling beyond the present $16,000 for couples or families, and/or adjusting upwards the mortgage servicing ratio (MSR) from the current 30%, seeing that prices of new ECs have increased in recent years. Another suggestion that was supported by many respondents was the raising of EC land supply under the Confirmed List of the government land sales (GLS) programme."

Raise monthly household income ceiling

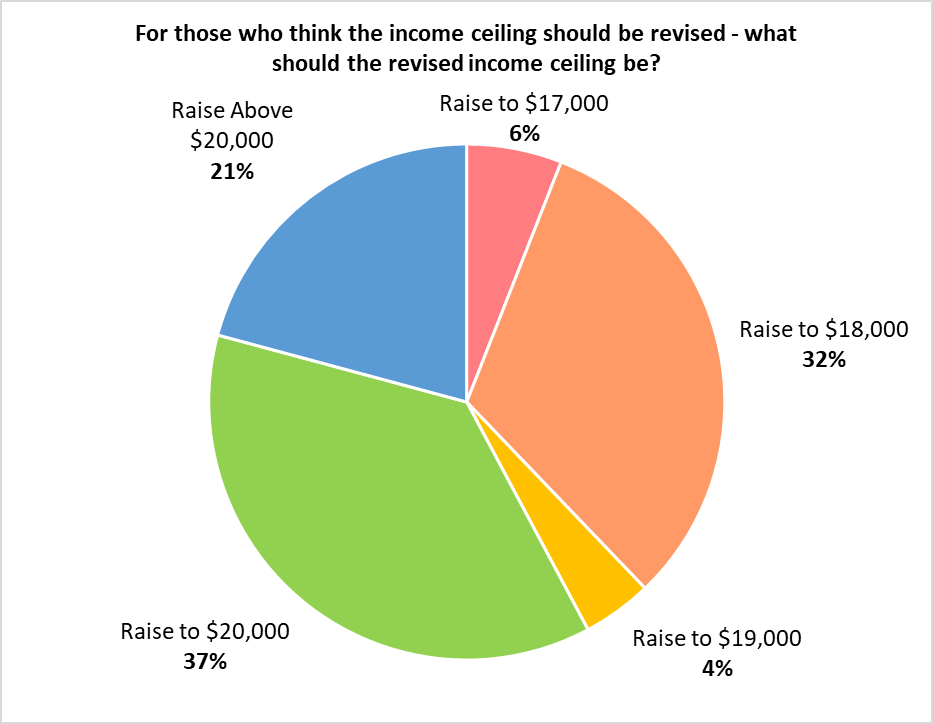

Pertaining to a question on whether the monthly household income ceiling should be amended, 55% of the respondents indicated that it should be revised, while the rest of the respondents felt that the current income ceiling is appropriate. Among the respondents who indicated that the monthly household income ceiling for new EC purchase should be revised, 37% of the respondents said it should be raised to $20,000, 32% of those polled indicated that an appropriate level would be $18,000, while 21% thought that it should be increased to above $20,000 (see Chart 3). The government last adjusted the monthly household income ceiling for new EC purchase to the current $16,000 (from $14,000) in 2019.

Chart 3: If it is to be revised, which is the appropriate monthly household income ceiling for new EC purchase?

Table 1: Illustration on EC purchase financing at various monthly income ceiling amounts

Monthly income ceiling | $16,000 | $18,000 | $20,000 |

Median new EC price in 2024* | $1,505,500 | $1,505,500 | $1,505,500 |

20% down-payment^ | $301,100 | $301,100 | $301,100 |

Max loan amount** | $909,000 | $1,020,000 | $1,135,000 |

Balance/shortfall | $295,400 | $184,400 | $69,400 |

Cash/CPF amount needed | $596,500 | $485,500 | $370,500 |

Monthly loan repayment | $4,798 | $5,384 | $5,991 |

30% MSR threshold | $4,800 | $5,400 | $6,000 |

At the prevailing household income ceiling of $16,000 per month, prospective EC buyers would be able to obtain a bank financing of around $909,000, based on an MSR of 30%, an interest rate of 4% p.a. and a 25-year loan tenure. Factoring in the bank loan amount, it would still leave a shortfall of about $295,000 to be paid (see Table 1), after the buyer puts a 20% downpayment of $301,100 under the Deferred Payment Scheme (DPS), assuming the EC purchase price at about $1.5 million (which was the median transacted price of new ECs in 2024 up till 26 May).

The downpayment and shortfall would come up to nearly $600,000 which the EC buyer has to pay in a combination of cash and monies from their Central Provident Fund (CPF) account. This is a substantial sum for many couples and may put new EC units out of their reach, if they do not have enough savings or access to financial help from family members. As an illustration, should the monthly household income ceiling be raised to $18,000 and holding other factors constant, the downpayment and shortfall drops to $485,500; this amount is reduced further to $370,500 if the income ceiling is raised to $20,000 per month.

Raise MSR beyond the current 30%

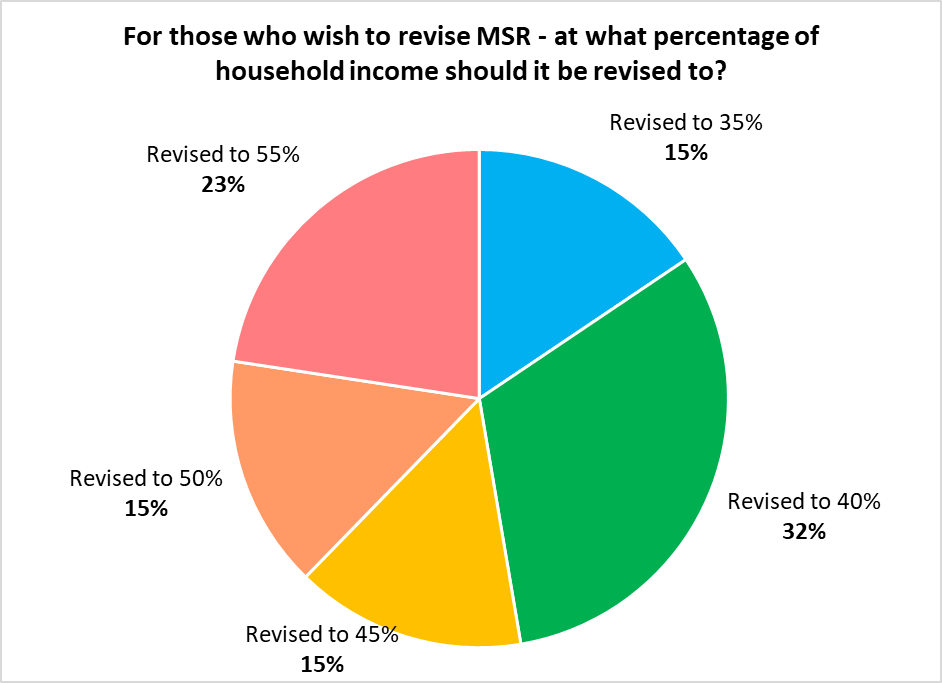

Meanwhile, survey findings showed that half (52%) of the respondents felt that the MSR should be revised for EC purchase, while 48% of those polled said it should remain at 30%. Among the respondents who indicated that the MSR should be revised, about one-third of them said it should be raised to 40%, while under a quarter of them felt that it would be apt for the MSR to be set at 55%. The remaining respondents are fairly evenly split at 15% each for MSR to be at levels of either 35%, 45%, or 50% (see Chart 4).

Chart 4: If it is to be revised, which is the appropriate MSR level for EC purchase?

The MSR refers to the portion of a borrower's gross monthly income that goes towards repaying all property loans. Presently, the MSR is capped at 30% of a borrower's gross monthly income and only applies to home loans for the purchase of an HDB flat or an EC (where the minimum occupation period of the EC has not expired). The MSR was first set at 40% during its inception, and was eventually brought down to 30% in 2013 for housing loans granted to HDB flat and new EC buyers.

Table 2: Number of responses on various suggestions to improve EC affordability

| Suggestions | Number of respondents who agreed with this suggestion* | Proportion of respondents (%) |

| Release more EC government land sales sites for tender | 721 | 58% |

| Raise household income ceiling beyond the current $16,000 for new EC purchase | 593 | 48% |

| Raise MSR beyond the current 30% for new EC purchase | 482 | 39% |

Wong Siew Ying, Head of Research and Content at PropNex, said, "Naturally, there will be concerns on the potential implications of such policy changes. For example, the adjustment to the monthly household income ceiling could lead to more higher income buyers entering the market, and may inadvertently crowd out households who earn less. Buyers may also be worried about the likelihood that some developers could seek to take advantage of the higher income ceiling and higher MSR by raising the selling price of ECs. Meanwhile, it is to be noted that raising the MSR could also increase buyers' debt obligation. Another way that could improve EC affordability is to inject more supply of such homes to cater to healthy demand by releasing more Confirmed List EC sites in the half-yearly GLS programme - a suggestion that resonated with about 58% of the respondents (see Table 2)."

In the last few years, the government has tended to release two Confirmed List EC sites for tender each year, leading to stiffer competition for such sites among developers which contributed to higher land bids. By ramping up the supply of EC sites - possibly to four Confirmed List plots per year - it could potentially help to rein in land bid prices by developers.

The other solutions that were suggested by respondents include setting a selling price cap on new EC units launched for sale, having a cap on the land bid price for EC sites sold via the GLS programme, further tightening the eligibility criteria for EC buyers, and raising government subsidies or grants to eligible buyers of new ECs.

Read the full report here.